If you’re a busy professional new to real estate investing, you’ve probably heard the term cash-on-cash return but might not fully understand what it means or why it matters-especially in the context of multifamily syndications and ground-up development projects like those Goodin Development specializes in.

This blog breaks down cash-on-cash returns in simple terms, explains how they work for passive investors, and clarifies how they differ from other important concepts like the preferred return.

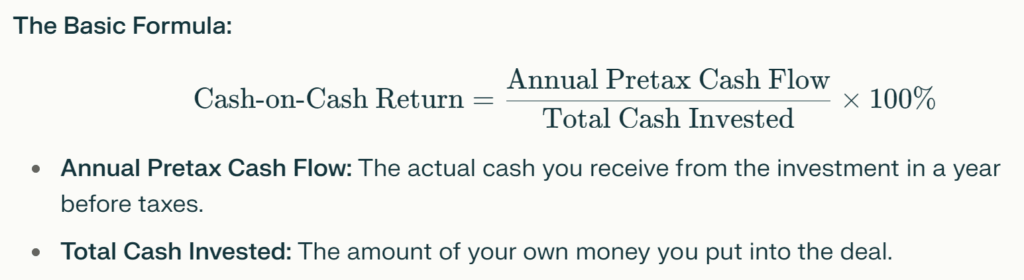

Cash-on-cash return is a way to measure how much cash income you’re earning compared to the cash you initially invested. It’s expressed as a percentage and helps investors quickly understand the annual cash flow performance of an investment.

Imagine you invest $100,000 in a rental property. After all expenses (mortgage, taxes, maintenance), you receive $6,000 in cash distributions over the year.

This means you’re earning a 6% return on your invested cash annually through cash flow.

In real estate syndications, you pool your money with other investors to buy or develop properties, and the sponsor manages the project. As a passive investor, you receive annual or quarterly cash flow distributions based on the property’s net income.

The cash-on-cash return only measures the cash flow you receive during the operational phase of the property. It does not include profits you may receive when the property is sold or refinanced at the end of the investment period.

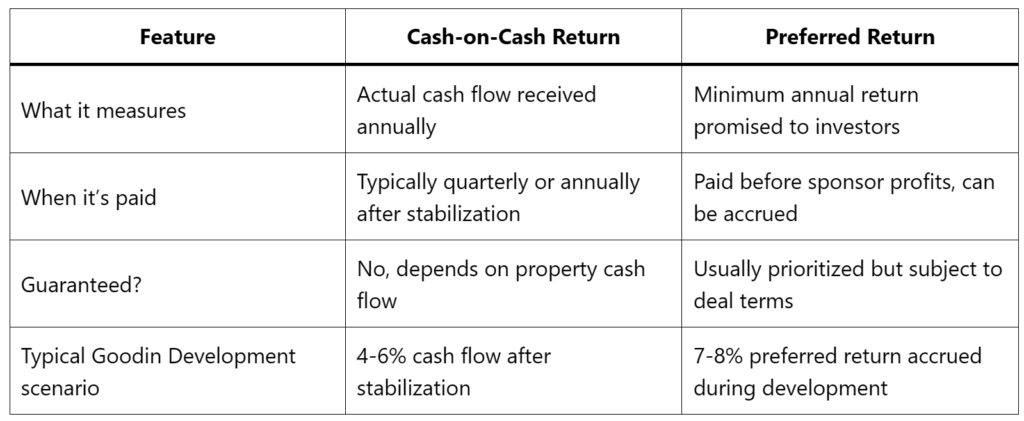

At Goodin Development, we focus on ground-up multifamily projects-meaning we build apartment communities from the ground up. During the construction phase (which typically lasts 14-24 months), there is no cash flow because the property isn’t generating rental income yet.

If the project yields a 5% cash-on-cash return, your annual cash flow would be: 50,000×5%=2,500 per year or about $625 per quarter.

This cash flow is separate from any profits you receive when the property is sold or refinanced at the end of the hold period (typically 3-7 years).

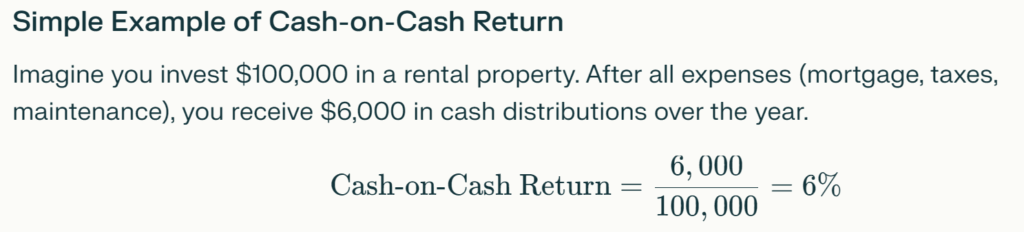

Preferred return (often called “pref”) is a promise by the sponsor to pay investors a minimum annual return on their invested capital before the sponsor receives any share of the profits.

Cash-on-cash return is a simple yet powerful metric to understand the cash income you’ll receive relative to your investment. However, in ground-up multifamily syndications like those from Goodin Development, it’s important to remember that cash flow starts only after the property is built and stabilized. Meanwhile, the preferred return sets the minimum annual return investors expect before sponsors share profits, but it is not the same as the cash-on-cash return.

By investing with Goodin Development, you gain access to professionally managed, high-quality ground-up multifamily projects designed to deliver steady passive income and long-term wealth growth.

If you want to learn more about how to evaluate passive real estate investments or explore current syndication opportunities, contact Goodin Development today.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Web design by Webisserie

No Offer of Securities—Disclosure of Interests. Under no circumstances should any material on this site be used or be considered as an offer to sell or as a solicitation of any offer to buy an interest in any investment. Any such offer or solicitation will be made only by means of the confidential private offering memorandum relating to the particular investment. Access to information about the investments are limited to investors who either qualify as accredited investors within the meaning of the Securities Act of 1933, as amended, or those investors who generally are sophisticated in financial matters, such that they are capable of evaluating the merits and risks of prospective investments. Past performance is not indicative of future results. All investments have risk and we strongly recommend you seek professional guidance before making any investment.