Why August Is the Perfect Time to Review Your Real Estate Strategy

If you’re a busy professional looking to invest passively in real estate, you’ve probably come across the term IRR or Internal Rate of Return. But what does it really mean, and why is it such a crucial metric in multifamily syndications and ground-up development projects like those offered by Goodin Development?

In this guide, we’ll break down IRR in plain English, show you how it works for passive investors, and explain how it differs from other return metrics like cash-on-cash return.

IRR is a way to measure the overall annualized return you can expect to earn on your investment, taking into account all the cash you receive over the life of the investment-including both regular cash flow distributions and profits from the sale or refinance at the end.

IRR (Internal Rate of Return) is a powerful investment metric because it takes into account the time value of money-a fundamental principle in finance. The time value of money means that a dollar you have today is worth more than a dollar you’ll receive in the future, simply because you can invest today’s dollar and earn a return on it over time. This concept recognizes that money can grow when invested, and that waiting to receive money means missing out on potential earnings.

Let’s consider a simple example: If you invested $100,000 and received $200,000 back, would that be a good investment? The answer depends on how long it took to double your money. If you got $200,000 back after just one year, you’d be thrilled-that’s an exceptional return. But if it took 30 years to receive that $200,000, you’d likely be much less excited, since inflation and lost investment opportunities would greatly reduce the value of that return over such a long period.

This is exactly why IRR is so useful: it calculates your annualized rate of return by factoring in both the amount and the timing of every cash flow you receive. IRR helps you compare investments with different cash flow patterns and timeframes, so you can see which opportunity truly grows your wealth the fastest-not just which one pays back the most dollars in the end.

In simple terms:

IRR tells you the average yearly rate your money “grows” while it’s invested in the project, considering both the timing and amount of all cash flows.

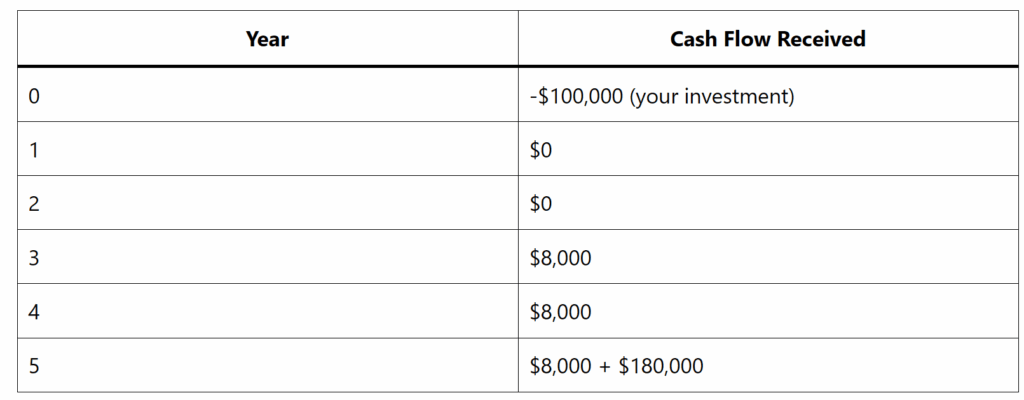

Let’s use a ground-up multifamily development as an example (the kind of project Goodin Development specializes in):

Suppose you invest $100,000 in a ground-up multifamily development syndication with a projected 20% IRR over a 5-year hold.

If you plug these cash flows into an IRR calculator or Excel, the IRR comes out to just over 20%.

What does this mean?

Your investment “grew” at an average annual rate of 20% over the five-year period, accounting for both the annual distributions and the big payout at the end.

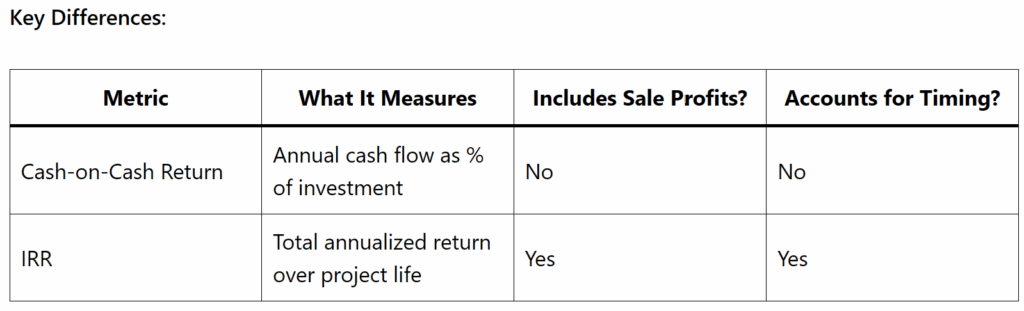

Cash-on-cash return only looks at the cash you receive each year from operations (like rental income).

IRR looks at all cash flows-including the big profit at sale or refinance-and when you receive them.

Preferred return is the minimum annual return (often 7-8%) that investors are promised before the sponsor gets paid.

Typical IRR targets for ground-up multifamily development:

IRR is the gold standard for measuring total investment performance in passive real estate syndications. For busy professionals investing with Goodin Development, understanding IRR helps you see the big picture-not just the annual cash flow, but the full value of your investment over time.

Ready to learn more or see current opportunities?

Contact Goodin Development today and let’s build your passive income and long-term wealth together.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Web design by Webisserie

No Offer of Securities—Disclosure of Interests. Under no circumstances should any material on this site be used or be considered as an offer to sell or as a solicitation of any offer to buy an interest in any investment. Any such offer or solicitation will be made only by means of the confidential private offering memorandum relating to the particular investment. Access to information about the investments are limited to investors who either qualify as accredited investors within the meaning of the Securities Act of 1933, as amended, or those investors who generally are sophisticated in financial matters, such that they are capable of evaluating the merits and risks of prospective investments. Past performance is not indicative of future results. All investments have risk and we strongly recommend you seek professional guidance before making any investment.