Why August Is the Perfect Time to Review Your Real Estate Strategy

When evaluating ground-up multifamily development opportunities, investors often encounter three crucial metrics: Cash-on-Cash Return, Equity Multiple, and Internal Rate of Return (IRR). Understanding these metrics is essential for making informed investment decisions.

Let’s break down each one and explore how they relate to ground-up multifamily projects.

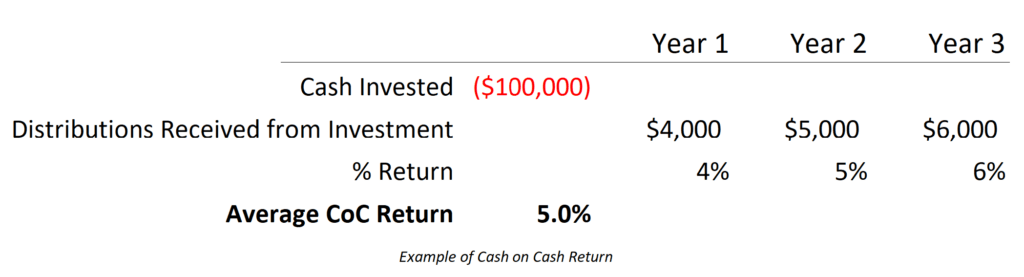

1. Cash-on-Cash Return

Definition: Cash-on-Cash (CoC) return is the ratio of annual cash flow to the total cash invested. It’s expressed as a percentage and provides a simple way to measure the cash income earned on the cash invested in a property.

Formula: CoC Return = Annual Cash Flow / Total Cash Invested

In ground-up multifamily developments: CoC returns are typically lower or non-existent during the construction phase (because the property is being constructed), but increase as the property stabilizes and begins generating rental income.

What’s considered a ‘good’ CoC return?

For stabilized multifamily properties, a CoC return of 3% – 6% is generally considered good, though this can vary based on market conditions and property type.

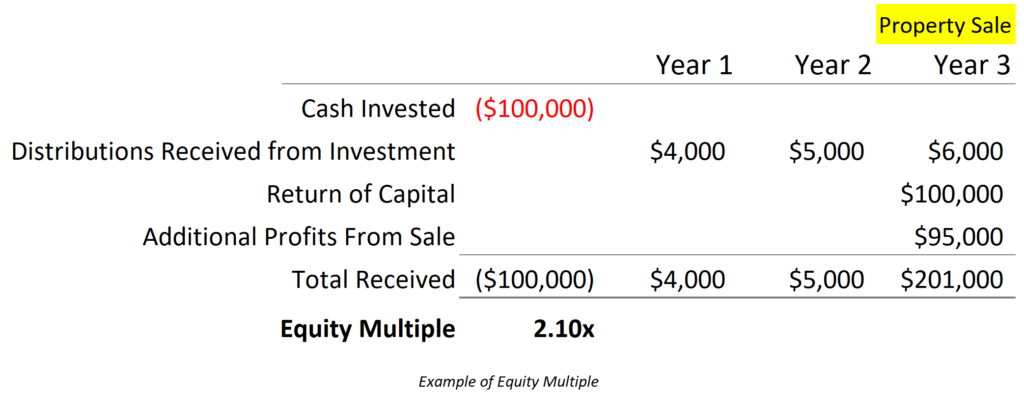

2. Equity Multiple

Definition: The Equity Multiple is the total cash distributions received from an investment, divided by the total equity invested. It shows how many times over an investor gets their initial investment back.

Formula: Equity Multiple = Total Cash Distributions / Total Equity Invested

In ground-up multifamily developments: The Equity Multiple takes into account both ongoing cash flow and the proceeds from the eventual sale or refinancing of the property. It provides a comprehensive view of the investment’s performance over its entire life cycle.

Basically, when it’s all said and done, the EM shows you how many times you have multiplied your equity. If you invested $100,000 and received a 2x on your investment, you would walk away with $200,000 counting all distributions and proceeds from a sale.

What’s considered a ‘good’ EM?

An Equity Multiple of 1.5x to 2x over a 3 to 5-year hold period is generally considered very attractive for ground-up multifamily developments.

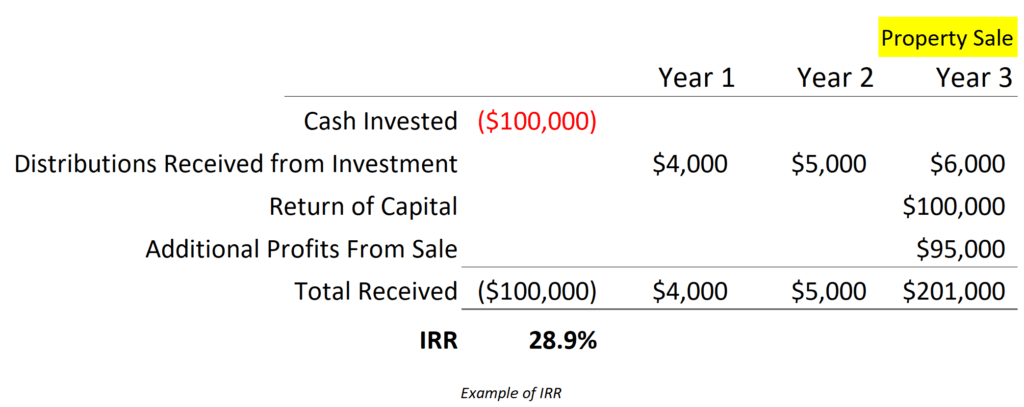

3. Internal Rate of Return (IRR)

Definition: IRR is the annualized rate of return that makes the net present value of all cash flows equal to zero. It takes into account the time value of money and provides a way to compare investments with different time horizons.

In ground-up multifamily developments: IRR is particularly useful because it accounts for the fact that returns are typically back-weighted in development projects. Initial years may see negative cash flows during construction, followed by increasing returns as the property stabilizes and appreciates.

The IRR helps investors determine if the investment is sufficient enough, based on the amount of time it takes to receive those returns. If you invested $100K and received $300k back, is that a good deal?

Well, it depends…

You need to consider the length of time it took to receive that $300K.

I bet you would be less excited if it took 30 years to earn that $300k vs. if it took 7 years.

That’s where the IRR, or internal rate of return, comes in.

What’s considered a ‘good’ IRR?

For ground-up multifamily developments, target IRRs typically range from 15% to 20% or higher, depending on the project’s risk profile and market conditions.

How These Metrics Relate to Ground-Up Multifamily Developments

In a typical ground-up multifamily development project, your return on investment might look like this:

Years 1-2 (Construction Phase):

Years 2-3 (Stabilization Phase):

Years 4-7 (Mature Operation/Exit):

It’s important to note that these metrics are interrelated but provide different insights:

When evaluating ground-up multifamily opportunities, investors should consider all three metrics alongside other factors such as market conditions, developer track record, and overall risk profile. By understanding these key metrics, investors can make more informed decisions and better align investment opportunities with their financial goals.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Web design by Webisserie

No Offer of Securities—Disclosure of Interests. Under no circumstances should any material on this site be used or be considered as an offer to sell or as a solicitation of any offer to buy an interest in any investment. Any such offer or solicitation will be made only by means of the confidential private offering memorandum relating to the particular investment. Access to information about the investments are limited to investors who either qualify as accredited investors within the meaning of the Securities Act of 1933, as amended, or those investors who generally are sophisticated in financial matters, such that they are capable of evaluating the merits and risks of prospective investments. Past performance is not indicative of future results. All investments have risk and we strongly recommend you seek professional guidance before making any investment.