While many people are familiar with buying single-family homes or rental properties, investing in real estate syndications (group investments) can seem daunting for newcomers.

Let’s break down the process to help you confidently approach your first syndication investment.

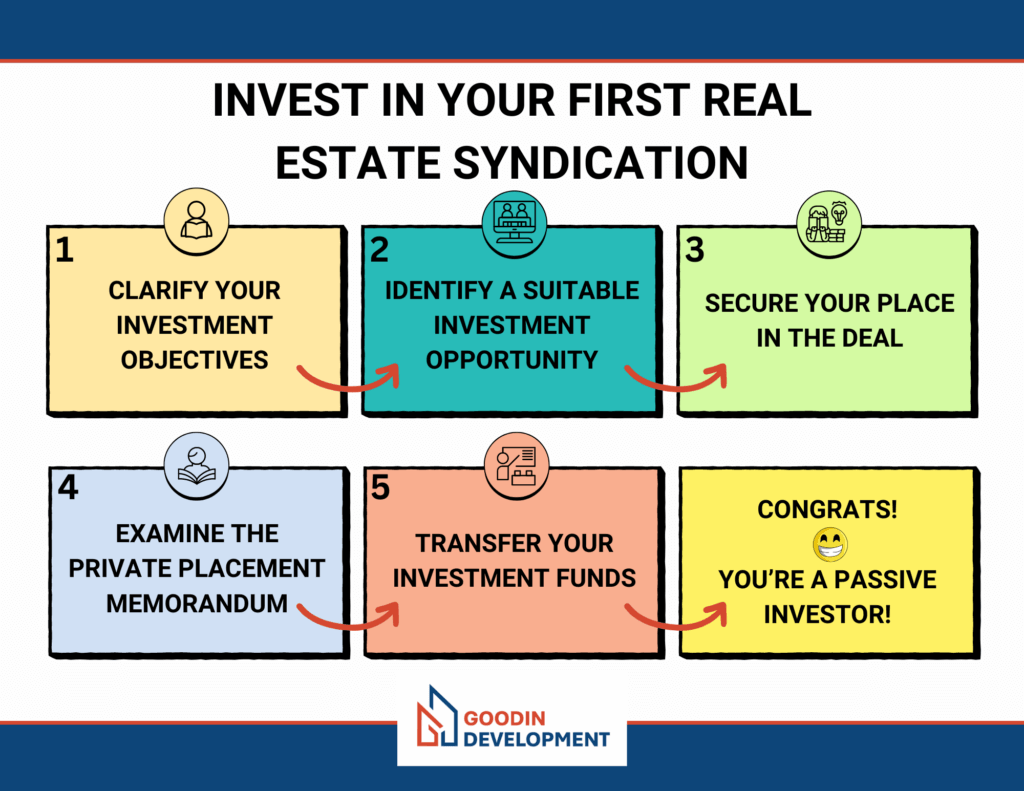

The Five Key Steps to Investing in a Real Estate Syndication:

Step #1 – Clarify Your Investment Objectives

Before diving into syndications, reflect on your short-term and long-term financial goals. Consider your available capital, preferred investment duration, desired tax benefits, and whether you’re prioritizing regular cash flow, long-term appreciation, or a combination of both.

Step #2 – Identify a Suitable Investment Opportunity

Seek out deals that align with your investment goals. Syndication projects range from new construction to value-add properties and turnkey investments. Sponsors typically provide comprehensive information, including an executive summary, full investment prospectus, and investor webinars.

Thoroughly evaluate the sponsor team, scrutinize the investment materials, and assess the business plan’s viability. Research market trends, review minimum investment requirements, projected timelines, and expected returns. Participate in investor webinars and ask probing questions.

At this stage, your goal is to identify any potential red flags that might deter you from investing.

Step #3 – Secure Your Place in the Deal

Once you’ve found an appealing opportunity, act quickly to reserve your spot. Many deals fill up rapidly, often within hours. Having completed your research and clarified your investment amount beforehand is crucial.

Some offerings may allow for a “soft reserve,” which holds your place while you review the materials more thoroughly. This option lets you back out or adjust your investment without penalty if needed.

Step #4 – Examine the Private Placement Memorandum (PPM)

After deciding to invest, your first formal step is to review and sign the PPM. This legal document outlines the investment details, associated risks, and your role as an investor. While it may be tedious, understanding this document is vital.

As part of this process, you’ll also determine how to hold your shares and choose your distribution method.

Step #5 – Transfer Your Investment Funds

The final step is to send your funds, typically via wire transfer. The PPM usually includes the necessary wiring instructions.

Pro tip: Verify the wiring details and notify the deal sponsor of the incoming transfer.

Conclusion

Understanding the syndication investment process should now feel less intimidating. These investments are generally passive after the initial setup, with most of your active involvement occurring during the selection and commitment phases.

Remember, if you still find this process challenging, that’s what we’re here for. We’ll guide you through each step of your first real estate syndication investment. With experience, this process will become second nature to you.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Web design by Webisserie

No Offer of Securities—Disclosure of Interests. Under no circumstances should any material on this site be used or be considered as an offer to sell or as a solicitation of any offer to buy an interest in any investment. Any such offer or solicitation will be made only by means of the confidential private offering memorandum relating to the particular investment. Access to information about the investments are limited to investors who either qualify as accredited investors within the meaning of the Securities Act of 1933, as amended, or those investors who generally are sophisticated in financial matters, such that they are capable of evaluating the merits and risks of prospective investments. Past performance is not indicative of future results. All investments have risk and we strongly recommend you seek professional guidance before making any investment.