Why August Is the Perfect Time to Review Your Real Estate Strategy

Have you ever dreamed of owning a piece of a large apartment complex, but thought it was out of reach? Enter the world of real estate syndications – a powerful investment strategy that’s opening doors for everyday investors to participate in lucrative real estate deals alongside seasoned professionals.

In this blog, we’ll dive deep into what real estate syndications are, how they work, and why they’re becoming increasingly popular among savvy investors looking to build wealth through real estate. Let’s get started!

What is a Real Estate Syndication?

In the most basic terms, a real estate syndication is a way for a group of investors to pool their capital together to invest in projects much bigger than they could afford to buy or manage on their own.

Instead of one person developing a $50 million apartment project, a group of investors come together, each investing a fraction of the total amount needed. This allows individuals to participate in large-scale, potentially more profitable real estate investments that would otherwise be out of reach.

How Does a Real Estate Syndication Work?

In a typical real estate syndication, there are two main parties involved:

1. The Developer (also known as the sponsor or general partner):

This is the person or company that finds the deal, coordinates the predevelopment work, arranges the financing, and oversees the project from start to finish.

2. The Passive Investors (also known as limited partners):

These are individuals who invest their money into the deal but are not involved in the day-to-day operations of the project.

Here’s a basic overview of how the syndication process usually works:

The Awesome Benefits of Real Estate Syndications for Passive Investors

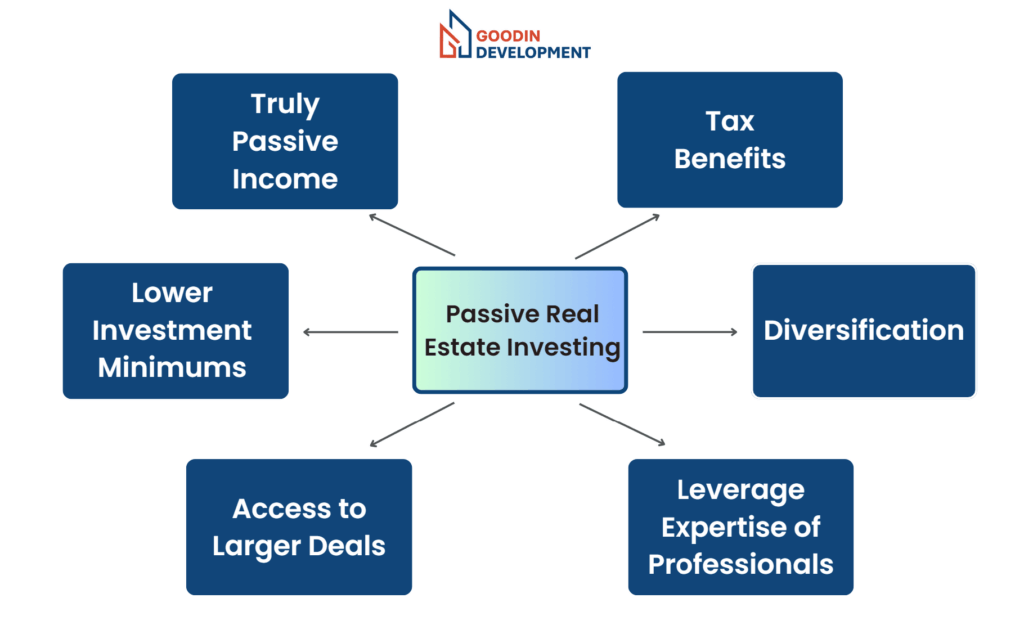

Now that we understand what real estate syndications are and how they work, let’s explore why they’re such an attractive option for passive investors.

Real estate syndications allow you to invest in institutional-quality properties that would typically be out of reach for individual investors. Instead of buying a single-family rental, you can own a chunk or a larger apartment project. These larger properties benefit from economies of scale, are easier to manage, and offer depreciation for investors.

Unlike owning rental properties directly, investing in a syndication is 100% passive. You don’t have to deal with tenants, toilets, or trash. The developer handles all aspects construction, property management, and bookkeeping. You can sit back, relax, and collect your share of the profits.

When you invest in a syndication, you’re partnering with experienced real estate professionals. These developers often have years of experience and a proven track record in finding, building, and managing projects. You benefit from their expertise without having to become a real estate expert yourself.

Syndications allow you to spread your investment across multiple properties or even different types of real estate. Instead of putting all your money into one property, you can invest smaller amounts in several syndications, diversifying your real estate portfolio and potentially reducing risk.

Real estate investing comes with significant tax advantages, and syndications allow you to access these benefits without the headaches of direct ownership. You may benefit from depreciation write-offs, which can shelter a portion of your cash flow from taxes. Additionally, when the property is sold, you may have the option to defer capital gains taxes through a 1031 exchange.

However, tax implications can be complex and vary based on individual circumstances. Always consult with a qualified tax professional for advice tailored to your situation.

Most syndications provide regular cash distributions to investors, often on a quarterly basis. This steady stream of passive income can be a great way to supplement your regular income or build wealth over time.

Goodin Development solely focuses on ground up development projects, so we start quarterly distributions after the project is fully built and stabilized.

In addition to cash flow, you also stand to benefit from any appreciation in the property’s value over time. When the property is eventually sold, you’ll receive your share of the profits, which can be substantial if the developer has successfully built and stabilized the project.

Investing in a syndication development project requires much less time and effort compared to directly owning and managing a rental property of your own. After your upfront due diligence of the developer and the project, your time commitment is minimal – mainly just reviewing monthly updates from the developer.

While minimum investments vary, many syndications allow you to invest with as little as $50,000. This is significantly less than what you’d need to purchase a property on your own, making real estate investing more accessible.

Good syndicators provide monthly, detailed updates on the property’s performance. This transparency allows you to stay informed about your investment without having to be directly involved in the operations.

Conclusion: Is a Real Estate Syndication Right for You?

Real estate syndications offer a unique opportunity to invest in large, potentially lucrative real estate deals without the hassles of direct property ownership. They provide access to institutional-quality investments, professional management, and the potential for attractive returns, all with a relatively low time commitment.

However, like any investment, syndications come with risks. It’s crucial to do your due diligence, both on the syndicator and the specific deal, before investing. Look for syndicators with a proven track record, clear communication, and a solid business plan.

Here at Goodin Development, we utilize the real estate syndication structure for our ground up multifamily development projects. Meaning, we partner with passive investors to fund a portion of the costs for our development projects.

If you’re looking for a way to diversify your investment portfolio, generate passive income, and potentially build long-term wealth through real estate, a syndication structure might be just what you’re looking for.

Remember, every investment carries risk, and it’s always wise to consult with a financial advisor to ensure that real estate syndications align with your personal financial goals and risk tolerance. Happy investing!

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Web design by Webisserie

No Offer of Securities—Disclosure of Interests. Under no circumstances should any material on this site be used or be considered as an offer to sell or as a solicitation of any offer to buy an interest in any investment. Any such offer or solicitation will be made only by means of the confidential private offering memorandum relating to the particular investment. Access to information about the investments are limited to investors who either qualify as accredited investors within the meaning of the Securities Act of 1933, as amended, or those investors who generally are sophisticated in financial matters, such that they are capable of evaluating the merits and risks of prospective investments. Past performance is not indicative of future results. All investments have risk and we strongly recommend you seek professional guidance before making any investment.