In June 2025, Goodin Development successfully closed on construction financing for The Elwood, a transformative $26 million mixed-use development in Kokomo, Indiana.

This case study provides complete transparency into our development process, from initial site acquisition through construction commencement, offering prospective and current investors a detailed look at how we structure, finance, and execute Class-A developments in Indiana markets.

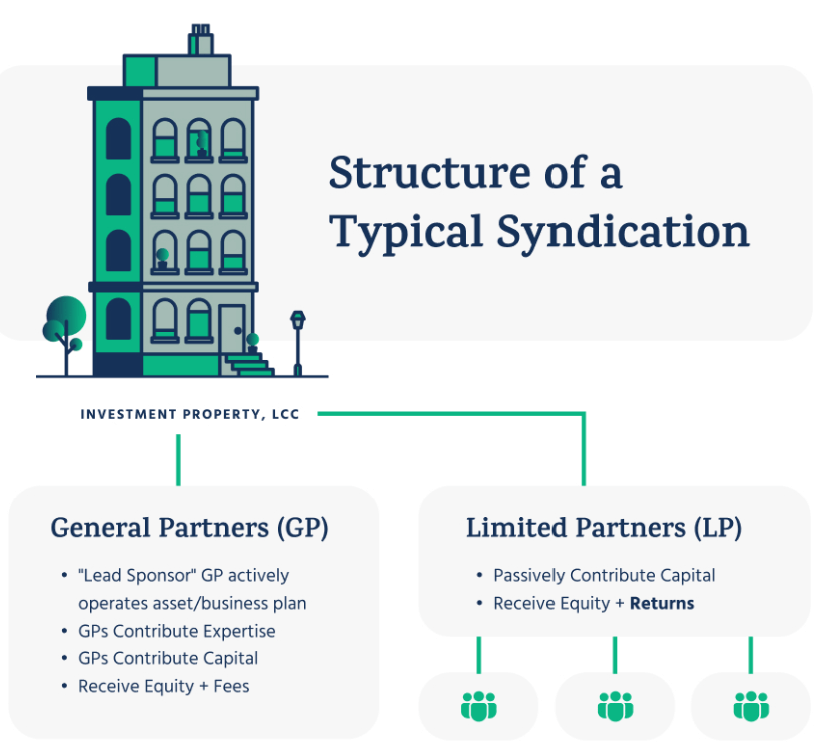

Real estate syndication is a fancy term for a group investment. This is a powerful investment vehicle that allows multiple investors to pool their capital together to acquire or develop properties that would be impossible to do individually. In a syndication, passive investors contribute capital and become actual partners in the project and owning real equity in the property.

There are two sides to every real estate syndication: The general partners and the limited partners. The general partner (Goodin Development) finds the investment opportunity, signs on the bank loan, oversees the contractors, and manages the project from start to finish.

Limited partners contribute capital to the project, in exchange for real ownership (equity) in the deal. They are not burdened with day to day operations of the investment and receive updates every month from the general partner.

Our passive real estate investors are true partners in The Elwood development. They hold ownership stakes in the property itself, meaning they participate in all cash flows, tax benefits, and appreciation that the property generates over time. This structure allows busy professionals and families to build wealth through real estate without the day-to-day responsibilities of property management, tenant relations, or construction oversight.

Total Project Cost: $26,000,000

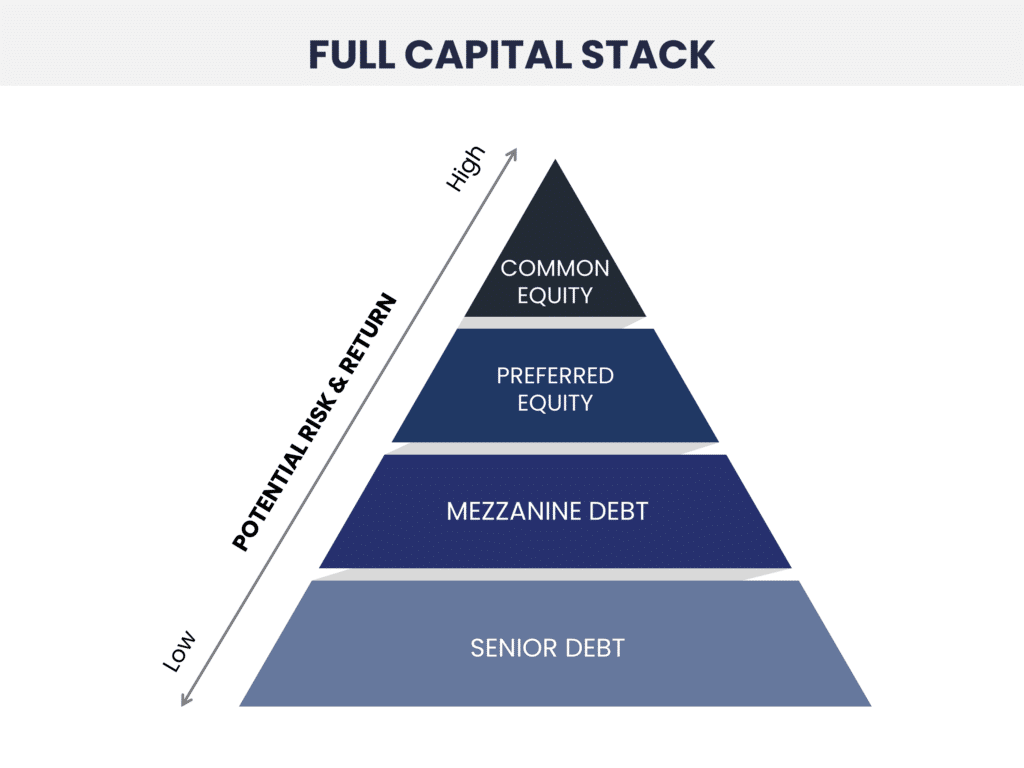

Preferred equity is a hybrid financing tool that sits between traditional debt and common equity. Preferred equity investors receive priority returns before common equity holders, typically at a fixed rate, and they do not participate in the upside potential of the project. It’s equity that is treated like debt.

Our Preferred Equity Investment: $2,000,000

Why We Chose Preferred Equity: Preferred equity allowed us to increased our leverage on the deal which will potentially boost the returns significantly to our common equity investors. The preferred equity investor will be capped at a 15% CAGR. They will not participate in the upside at sale. After receiving a 15% return, the preferred equity investor is out of the deal and ALL the upside is given to the common equity investors.

Preferred Equity Pros:

Preferred Equity Cons:

We successfully raised $3,342,527 from passive real estate investors, all positioned in the common equity tier. This means our investor partners share in all cash flows and appreciation after preferred returns are satisfied.

We partner with busy families in all of our projects. The Elwood was offered to members of our Investor Club as a Regulation D, 506B offering. This S.E.C. offering type allows us to raise capital from accredited and non accredited investors.

45 families partnered with us to fund the common equity portion of The Elwood! Are you interested in being notified when we have our next opportunity? Get early access here.

Key Investment Protection: No investor capital was spent on predevelopment costs until the site was fully rezoned and approved by the City, significantly reducing development risk for our investors.

Goodin Development partnered with the City of Kokomo to build The Elwood. The partnership allows us to deliver a premium Class-A development while the city benefits from increased tax revenue, job creation, quality housing, and a catalyst project that will attract additional investment to the area.

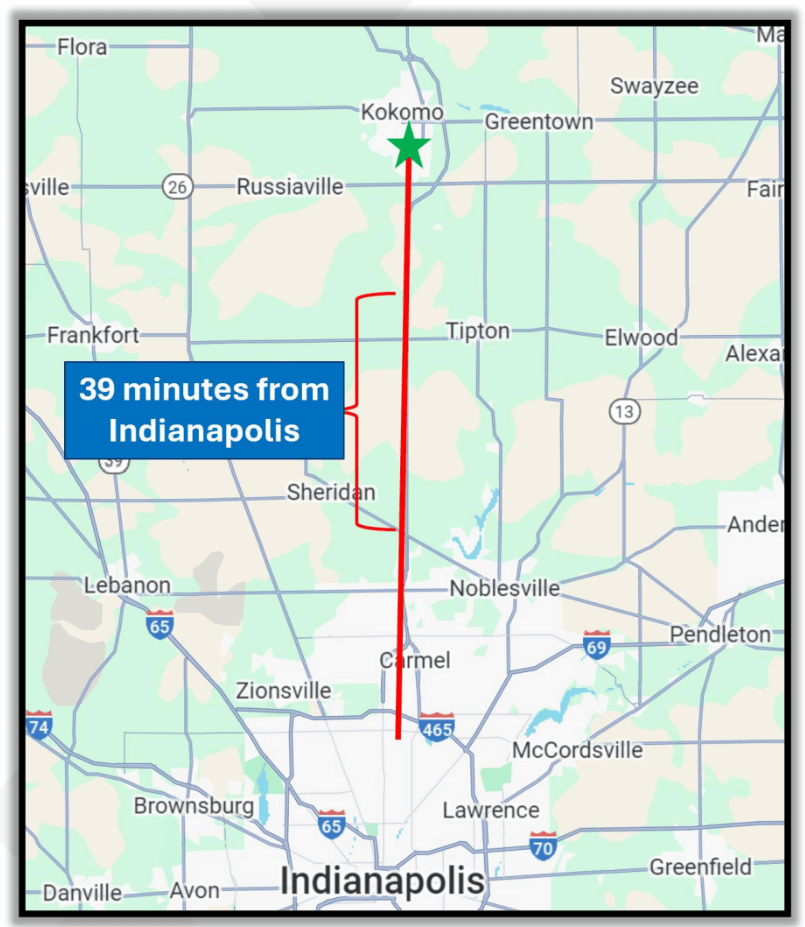

Kokomo is 39 minutes away from thriving Indianapolis.

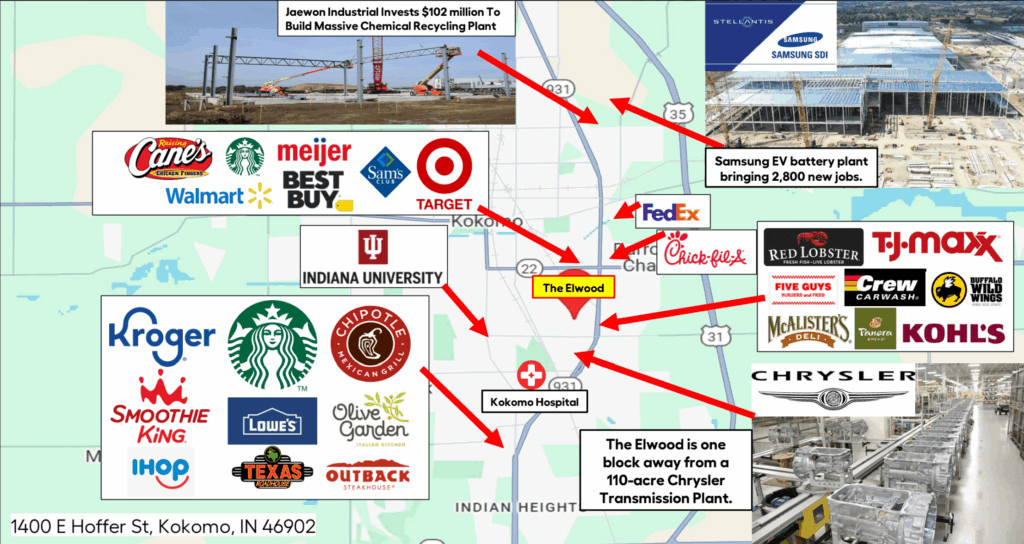

The site location in the growing southeast corridor of Kokomo provides excellent access to major employers and transportation routes while positioning the development in an area primed for continued growth and appreciation.

The Elwood is surrounded by various restaurants, retail stores, and major employers within the city. This site is 7 minutes away from the new two-phase $6.3 billion EV battery plant bringing 2,800 jobs to Kokomo. The site is also minutes away from a new Jaewon Industrial plant, who will be investing $102 million to build massive chemical recycling plant.

A transformative $26 million mixed-use development is rising in the heart of Kokomo, Indiana. The Elwood represents a groundbreaking public-private partnership with the City of Kokomo that will establish a new benchmark for luxury living in the region.

Named in honor of Elwood Haynes, the Indiana-born industrialist and inventor who put Kokomo on the map, this project celebrates the city’s rich history of innovation while boldly advancing its future. The Elwood delivers a thoughtfully designed, market-rate, Class-A community that seamlessly integrates premium residential living with sophisticated commercial space.

114 Class-A Units featuring a carefully curated mix of one- and two-bedroom apartments designed for the modern day renter.

Premium Unit Amenities:

The Elwood’s amenity package will set the new standard for luxury living in Kokomo:

The development includes 3,000 square feet of premium commercial space specifically designed for an office user or small business.

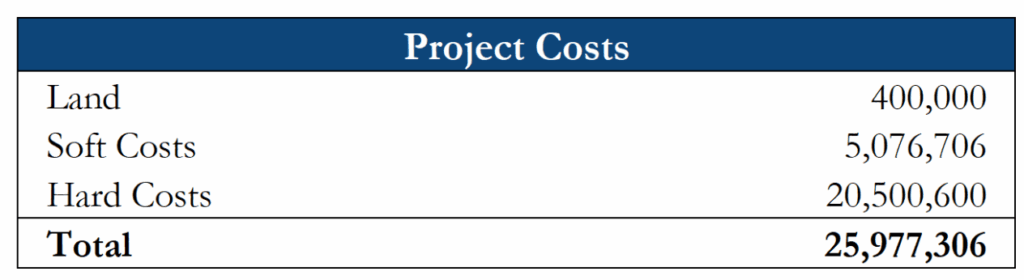

The cost to build the project (hard costs) and the price we signed a G.M.P. at is $20,500,600. Our soft costs, including the land, all fees, and reserves is $5,476,706.

Every real estate investment has risk, no doubt about it. We mitigated risk for this project in the following ways:

$1M+ Contingency & Reserves

Set aside over $1 million to cover unexpected construction costs or delays.

0% Rent Growth for 2 Years

Rent growth in Kokomo was 9% in 2024. We underwrote the deal assuming no rent increases for the first two years to stay conservative on revenue projections. We are not trending rents through the construction period.

10 Months of Interest Reserve

Built in 10 months of interest payments held in reserve to cover debt service during lease-up and stabilization.

55% Loan-To-Cost

Kept leverage low with a 55% LTC, reducing debt risk and providing greater financial flexibility.

GMP

We secured a Guaranteed Maximum Price (GMP) contract, which locks in construction costs and shifts the risk of overruns to the contractor — providing valuable cost certainty and protecting the developer’s bottom line. While a GMP isn’t absolute, and certain costs like approved change orders or unforeseen conditions can still be the developer’s responsibility, it remains one of the strongest tools for controlling construction risk.

Exit Cap Rate Assumptions

In our underwriting model, we separate the sale value of the residential and commercial component. We are projecting an exit cap rate of 6% for the residential apartments and 7.5% on the commercial component. We felt both of these exit cap rate assumptions were very realistic for a luxury A-class community in an under supplied market.

The development team charged a development fee that was 4.95% of the total project costs. Only one-third of this fee was paid out at closing. Two-third of the fee stays in the project and will be used as contingency, if needed. If the remaining development fee is not spent as contingency, it will be paid out at construction completion and at stabilization.

After the project is stabilized, an asset management fee equal to 2% of the collected income will be charged to support ongoing operations.

No refinance, disposition, or loan guarantor fees will be charged.

May 2024 – Goodin Development secured the 2.89-acre site under contract.

December 2024 – Completed cash purchase of the development site.

Late 2024 – Finalized comprehensive project agreement with the City of Kokomo.

February 2025 – Created a new PUD and successfully rezoned the property for mixed-use development.

March 2025 – Launched capital raising campaign with passive investors.

June 2025 – Finalized all municipal incentive agreements, closed construction financing with, and started construction.

Projected Completion – 16 months from groundbreaking.

The Elwood is being delivered by an experienced team of professionals, each with extensive track records in Class-A mixed-use development:

Each team member was selected based on their demonstrated ability to deliver premium projects on time and within budget, ensuring The Elwood meets the highest standards of quality and craftsmanship.

We believe in keeping our investors actively engaged and informed throughout every stage of the project. Investors receive exclusive invitations to key ceremonial events, including the groundbreaking ceremony and the ribbon cutting and grand opening celebration.

Throughout construction, we provide comprehensive monthly email updates featuring detailed progress reports, photos, professional drone video footage, and timeline updates highlighting key milestones. Financial updates, including budget performance and capital activity, are also shared regularly. This transparent, consistent communication ensures our investor partners stay fully informed about their investment — while remaining completely passive in the day-to-day operations.

Design and Architecture: Working with the architect and design team on a blank canvas – you’re literally creating a work of art. Every decision impacts aesthetics, functionality, construction costs, and the resident experience.

Legal Coordination: Negotiating operating agreements between attorneys. Coordinating closing requirements between the bank, bond purchaser, and other third parties.

Environmental Concerns: Minor environmental issues on the site were discovered during due diligence, but these were successfully mitigated through the planned installation of a vapor barrier system.

Goodin Development maintains laser focus on developing Class-A mixed-use properties exclusively within Indiana. Our mission is straightforward: help busy families build wealth through real estate investing without the hassles, headaches, and time commitments of being a landlord.

We specialize in identifying and developing high-quality opportunities in growing Indiana markets, managing every aspect of the development process while our investor partners enjoy the benefits of real estate ownership. Our selective approach allows us to deliver exceptional returns while maintaining the highest standards of transparency and communication throughout each project.

Sign up for our free 7-day Passive Real Estate Investing 101 email course so you can learn how to get started.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Web design by Webisserie

No Offer of Securities—Disclosure of Interests. Under no circumstances should any material on this site be used or be considered as an offer to sell or as a solicitation of any offer to buy an interest in any investment. Any such offer or solicitation will be made only by means of the confidential private offering memorandum relating to the particular investment. Access to information about the investments are limited to investors who either qualify as accredited investors within the meaning of the Securities Act of 1933, as amended, or those investors who generally are sophisticated in financial matters, such that they are capable of evaluating the merits and risks of prospective investments. Past performance is not indicative of future results. All investments have risk and we strongly recommend you seek professional guidance before making any investment.